The state of the world energy market is of great concern to many people who follow US-Saudi relations. Today we are pleased to share with you the remarks of Saudi Aramco CEO Abdallah S. Jum'ah who addressed the questions of global energy security and Asia's role in the market in his "State of the Industry" address to the Asia Oil and Gas Conference in Kuala

Lumpur. Mr. Jum'ah spoke via video link from Jeddah on June 12, 2006.

|

Certainly today's prices cannot be justified simply on the basis of supply-demand fundamentals. As we all know, supplies are secure, demand is being met, and global inventory levels are comfortable. So, why are we continuing to see prices in the seventy-dollar

range?

|

Asia Oil & Gas Conference - State of the Industry Address

Abdallah S. Jum'ah

President and Chief Executive Officer, Saudi Aramco

Bismillah al-Rahman al-Rahim; as-Salaam Alaykum. Honored guests, ladies and gentlemen; good morning and greetings from the Kingdom of Saudi Arabia. I regret that I was not able to join you today in person, or to enjoy the tremendous diversity and great dynamism of Malaysia first-hand. I was so looking forward to this trip, and an opportunity to sample the contemporary splendor of Kuala Lumpur, see the natural beauty of the countryside, and experience the warm hospitality of the Malaysian people. I was also hoping to escape the 45-degree heat we're experiencing here in Dhahran this week! However, I am glad that modern technology permits me to participate from afar. I would like to begin by expressing my deep appreciation to my friend Tan Sri Dato' Sri Mohammad Hassan Marican and the conference organizers for the honor of delivering this year's state-of-the-industry address.

I consider it a particular honor to participate in the Asia Oil & Gas Conference, not only because Saudi Arabia is an integral part of the region, but also because the Far East is the destination for roughly fifty percent of Saudi Aramco's crude oil exports and well over half of our refined product and NGL exports. Of course, we also have substantial refining and marketing joint ventures in the region, and are partnering with Asian firms in a number of domestic initiatives, including major undertakings in both the upstream gas and downstream petrochemical sectors.

So it is indeed a pleasure to share my thoughts on the current state of the petroleum industry, and the ramifications those conditions have for the Asia-Pacific region. In particular, I would like to provide my perspectives on the critical issue of global energy security, and Asia's role in the market today-and tomorrow.

Without a doubt, energy security concerns have always been an important aspect of the oil industry landscape, but a number of developments over the last several years have brought these anxieties to the forefront. Some of these factors are cyclical, while others are structural in nature; taken together, they create an environment in which worries about energy security and market stability assume a greater significance than would otherwise be the case. Just as a tree casts a longer shadow at sunrise and sunset, these various developments serve to magnify the importance of what would, in a different market environment, be rather tangential concerns. Let me elaborate.

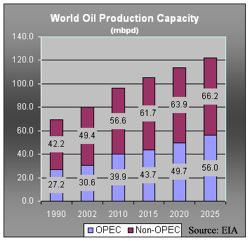

On the structural side, we are witnessing a reduction of supply from the OECD countries as production from those nations' fields continues to decline. As a result, non-OPEC production is becoming increasingly concentrated in a number of non-OECD countries. Declining OECD production also means that OPEC is set to play an even more central role in meeting future energy needs. Although established demand remains strong in the developed world, incremental demand growth is being led by non-OECD countries, and here of course we have to consider fast-growing economies such as China and India, as well as the nations of Southeast Asia. Worldwide, import volumes are also on the rise, and since more supply is coming from regions that are farther from the principal centers of demand, crude oil is traveling greater distances to market, with resultant stresses and strains for regional and global transportation networks.

On the structural side, we are witnessing a reduction of supply from the OECD countries as production from those nations' fields continues to decline. As a result, non-OPEC production is becoming increasingly concentrated in a number of non-OECD countries. Declining OECD production also means that OPEC is set to play an even more central role in meeting future energy needs. Although established demand remains strong in the developed world, incremental demand growth is being led by non-OECD countries, and here of course we have to consider fast-growing economies such as China and India, as well as the nations of Southeast Asia. Worldwide, import volumes are also on the rise, and since more supply is coming from regions that are farther from the principal centers of demand, crude oil is traveling greater distances to market, with resultant stresses and strains for regional and global transportation networks.

Structural developments are not, however, limited to quantitative factors. Rather, we must also look at qualitative issues like crude quality and product specifications. Overall, crude oil supplies are growing heavier and more sour; this is particularly true if we look specifically at global spare capacity, which is overwhelmingly composed of heavy, sour crudes. At the same time, demand for products is becoming whiter and lighter, and we are seeing a greater proliferation of tighter refined product specifications in various markets, largely due to governmental regulations in different localities. Caught in between is a worldwide refining system whose capacity is stretched and which is unable to handle these heavy, sour crudes, and which in many places will require substantial investment in order to meet more stringent end-user specs. All of this leads to even tighter product markets and higher product prices, of course.

Structural developments are not, however, limited to quantitative factors. Rather, we must also look at qualitative issues like crude quality and product specifications. Overall, crude oil supplies are growing heavier and more sour; this is particularly true if we look specifically at global spare capacity, which is overwhelmingly composed of heavy, sour crudes. At the same time, demand for products is becoming whiter and lighter, and we are seeing a greater proliferation of tighter refined product specifications in various markets, largely due to governmental regulations in different localities. Caught in between is a worldwide refining system whose capacity is stretched and which is unable to handle these heavy, sour crudes, and which in many places will require substantial investment in order to meet more stringent end-user specs. All of this leads to even tighter product markets and higher product prices, of course.

Exacerbating these structural developments are cyclical factors like a healthy global economy-which in turn means healthy

demand for petroleum. We are also seeing substantial increases in various commodity prices, which serve to drive up costs for infrastructure expansion programs and raise the price tags for new crude increments and grassroots facilities.

As a result, energy security is casting a very long shadow indeed, and energy issues have risen to the top of the agenda for many business leaders, policy makers and media pundits. Thus we see a greater sensitivity to any and all

threats to

supply -- real and perceived, natural and manmade, and both short- and long-term in nature. Without a doubt, perceptions of energy security are usually priced into the oil markets, giving rise to the

"fear

premium." Certainly today's prices cannot be justified simply on the basis of supply-demand fundamentals. As we all know, supplies are secure, demand is being met, and global inventory levels are comfortable. So, why are we continuing to see prices in the seventy-dollar range?

Part of today's price equation is tied to supply security issues themselves, but we also have to consider the distorting role that speculation plays in today's oil markets. Increased futures trading activities serve to amplify market worries and anxieties over future supplies, with an associated inflationary effect on prices. Furthermore, today's higher prices have risen largely on the back of surging demand, rather than just because of supply constraints like earlier price spikes.

|

.. non-OECD demand to grow by an annual average of 950,000 barrels per day over the next five years. Over half of that growth will be coming from Asia, and the center of gravity for energy demand growth is moving steadily

eastward..

|

|

But what role does Asia play in all of this, and what impact will political, economic and even socio-cultural developments in the region have on future energy markets? Certainly the emergence of China and India as major players on the global economic stage and in the international energy markets is an historic development, and clearly Asia as a whole will exert a significant influence on future energy trends. But I think that just as today's increasingly complex, high-price market leads to exaggerated concerns over energy security, we are also witnessing a fair degree of scaremongering when it comes to Asian energy demand and its impact on the supply-demand balance. I would like to revisit that issue in a moment. But what do the cold, hard facts tell us about this region and its need for petroleum?

As I noted earlier, incremental demand growth is found primarily outside of the OECD, and we estimate non-OECD demand to grow by an annual average of 950,000 barrels per day over the next five years. Over half of that growth will be coming from Asia, and the center of gravity for energy demand growth is moving steadily eastward. That will be a sustained trend, given this region's growing population, increasingly affluent societies and sustained economic growth. Thus, the Asia-Pacific region's weight in global oil markets will continue to grow.

|

.. measures to increase global energy security will be meaningless unless they

include Asia and the Pacific as willing participants..

|

|

Although Asia is perceived as a price taker, this region is not simply a passive observer sitting on the sidelines of the energy game. In recent years, we have witnessed the rise of a new breed of home-grown Asian energy companies that are both willing and able to compete globally. Most, though not all, of these Asian energy enterprises are national oil companies, and they have adopted a strategic approach to their business portfolios and a long-term perspective on their new ventures. Certainly Petronas is a good example of this kind of proactive firm, and I think such companies will also play a more influential role in international energy markets in the years and decades to come.

Without a doubt, then, developments in Asia have changed the dynamics of the international energy market-in my opinion, forever. Furthermore, because oil is a fungible commodity, measures to increase global energy security will be meaningless unless they include Asia and the Pacific as willing participants.

Some observers have focused on strong demand for petroleum in Asia-and in China in particular-as the principal driver behind today's inflated prices. However, viewed objectively, it is clearly unfair to lay the blame for higher prices solely at the doorsteps of Asian consumer countries. Aside from the effects of infrastructure bottlenecks and issues related to crude oil quality and product specifications, just in terms of sheer volumes the OECD countries still comprise the majority of demand for petroleum, with the United States alone accounting for a quarter of global oil consumption. Even if we look only at imports, the OECD nations taken together still exceed Chinese net imports, due in part to declining OECD production rates, but largely the result of the large established demand base in developed economies. Again, petroleum is fungible, and demand for a barrel of oil in Indiana or Italy has just as significant an impact on global prices as a barrel consumed in Indonesia.

Rather than pointing fingers and casting blame, surely it would be much more productive to work together to address both the structural and cyclical challenges that we all confront. If we are to be successful in those efforts, we have to consider both the supply and the demand sides of the equation, recognize that both producers and consumers have important roles to play in tackling industry issues, and understand that today's market is the product of a complex interplay of factors that cannot be addressed with either simplistic solutions or isolated initiatives.

Instead, I believe we need a clear and comprehensive vision of the energy future, which will be made reality by advanced technology, dedicated people and good old-fashioned hard work. That is why at Saudi Aramco, we are doing our part to meet these various challenges through a series of major initiatives all along the petroleum value chain, using not only our own resources but also drawing upon the strengths of our world-class partners, many of them from the Far East. I would like to share some of those initiatives with you.

Our efforts begin with a stepped up oil and gas exploration program. We currently manage approximately 260 billion barrels of oil, or roughly a quarter of the global total. But we continue to expand our reserve base, and conservatively estimate our additional potential of recoverable oil to be in the range of 200 billion barrels. At Saudi Aramco's present production levels, that means we will have well over a century's worth of oil to produce.

|

.. in the next five to six years we will be adding production

capacity.. .. which by the end of 2009 will reach 12 million barrels per day.. |

|

We are equally proactive when it comes to expanding our production capacity. Saudi Aramco currently has half a dozen major crude oil increments at various stages of development, with a total production capacity of some three million barrels per day. In other words, in the next five to six years we will be adding production capacity which exceeds the current production of Venezuela or Kuwait. Some of that capacity will offset natural decline, while the remainder will serve to expand our maximum sustained production capability, which by the end of 2009 will reach 12 million barrels per day.

At the same time, in keeping with Saudi Arabia's current oil policy and as a commitment to world oil markets, we will maintain our surplus production capacity of one-and-a-half to two million barrels a day, even as our actual production grows. This surplus capability is expensive to develop and maintain, but over the years it has repeatedly proven its worth, and so we bear this cost to promote market stability and continued global economic development.

We're also pursuing major initiatives further downstream. We are looking at the expansion of refining capacities in Korea through S-Oil, in the Philippines through Petron, and in the United States using our Motiva joint venture with Shell. And, of course, we are working with Sinopec on downstream projects in the People's Republic of China, in both Fujian and Shandong provinces. Saudi Aramco is also working with international partners to develop two export-oriented refineries in the Kingdom, which will not only help to alleviate the tight global refining situation, but since they are being designed to process heavier crudes, will also address the mismatch between today's crude slate and existing refinery configurations. Even further downstream, we have begun construction with Sumitomo Chemical on a world-class, integrated refining and petrochemical facility at our Rabigh Refinery, and are studying additional domestic petrochemical integration projects. In all of these various projects, we are taking care to protect and preserve the natural environment, and to lighten the carbon footprint of our various operations on the ecosystem.

We are also expanding the capacity of our Master Gas System, the largest natural gas network of its kind. Although Saudi Aramco is producing and processing gas to power the development and diversification of Saudi Arabia's economy, these operations do have a positive international impact. By using gas as the primary fuel and feedstock for domestic industries and utilities, we are able to redirect crude oil to international markets, helping to meet growing worldwide demand even as we continue to fulfill our domestic obligations.

Finally, our regional affiliate offices constitute another important aspect of our business, especially when it comes to Asia. In addition to our subsidiaries in the US and Europe, we have sales & marketing, logistics and purchasing offices in Singapore, Hong Kong, Beijing and Tokyo, with project engineering offices in a number of other Asian cities. This network is charged with listening to our customers, working with our vendors and service providers, helping us understand the complexities of these markets, and articulating the region's needs here in Dhahran. In the years to come, we will continue to invest in Asia and work to attract additional Asian investment in Saudi Arabia, because we believe this is our natural market and that you are our natural partners.

Ladies and gentlemen, we have undertaken these various efforts and initiatives because at Saudi Aramco, we understand the difference that a reliable supply of energy makes in the daily lives of individuals, families, larger communities and whole countries. That impact can certainly be seen in Asia, where each new generation builds on the proud legacy of the past, creating fresh opportunities and ensuring an even brighter future for the generation that will come. Whether we come from KL or Karachi, Bangkok or Beijing, Onsan or Osaka, Delhi or Dhahran, I think I can say with confidence that our fathers and grandfathers would scarcely recognize the world we live in today. That rapid transformation-in most cases unmatched in the long history of our respective societies-is the result of energy: the limitless energy and ingenuity of Asia's people, and the energy that companies like ours provide to power progress. Asia has abundant reserves of both, which is why I believe this is a golden age for our region, and why the next hundred years indeed promises to be what has been termed the "Asian century."

Thank you, Chairman Marican. Ladies and gentlemen, I appreciate your attention this morning, and allow me to wish each of you a successful symposium.

Source: Saudi Aramco Web Site

- Saudi Oil Production Capacity to Reach 12 Million bpd by 2009: Official - Asharq Alawsat - Jun. 13, 2006

- Asia demand growth not to blame for high oil: Saudi - The Peninsula - Jun. 13, 2006

- Saudi to increase oil production to 12 million barrels a day by 2009 - Khaleej Times - Jun. 13, 2006

- Future Energy Markets and the Role of Saudi Aramco - Saudi Aramco - Mar. 24, 2006

- Aramco�s Operating Plan for Next Year Approved - Arab News - Dec. 15, 2005

- The Outlook For The World Oil Market - John Browne - SUSRIS IOI - Dec. 19, 2004

- Saudi Arabian Oil Fields Brimming - Dimensions - Aug. 25, 2004

- Saudi Arabia Ready to Boost Crude Oil Output - SUSRIS IOI - Aug. 19, 2004

- Saudi Arabia's Oil Reserves - Dr. Sadad

Al-Husseini - SAF IOI - May 27, 2004

- U.S.-Saudi Relations and Global Energy

Security - Abdallah S. Jum'ah - SUSRIS IOI - May 18, 2004